Adaptability

From beginnings in coal mining to present-day interests in health, nutrition and biosciences, Royal DSM has shown it has the courage to change while remaining true to itself. The merger with Firmenich marks a continuation along this path, while Endress+Hauser is also in demand as an innovative partner.

At first glance, it is a rather unassuming material that emerges from the hopper mixer in hall 61 at the DSM site in Grenzach, Germany: a white, odorless powder resembling ground limestone. And yet everyone present knows the significance of this substance they call Bovaer. After more than a decade of research and development, DSM was able to prove that the feed additive suppresses the last enzyme step in a cow’s first stomach, the rumen, which is responsible for methane production. This reduces enteric methane emissions, contributing to a smaller environmental footprint for meat, milk and dairy products. Site manager Martin Häfele explains: “If a farmer feeds each animal a quarter teaspoon per day, the effect is a 30 percent reduction in enteric methane emissions from dairy cows and 45 percent from beef cattle. Feeding Bovaer to three cows is like taking one family-sized car off the road.”

The effectiveness of Bovaer is raising international hopes for climate protection. The EU approved the additive, noting the contribution made to its sustainable “farm to fork” strategy. Australia, Brazil, Argentina and Chile have also given Bovaer the green light. And among the first pilot customers is Arla Foods, one of the world’s largest dairy cooperatives. In order to meet the demand, in December 2022 DSM began investing more than 100 million euros in construction of a new plant in Dalry, Scotland, which is scheduled to start operating in 2025. According to Sjef Arets, Vice President of Manufacturing & Technology at DSM, Endress+Hauser is the main instrumentation vendor for the Bovaer project. Arets and his team are responsible for manufacturing and technology development within DSM’s Animal Nutrition & Health division at locations in Europe, China and Latin America. He too is very enthusiastic about the feed additive. “Bovaer looks to have real game-changing potential for the world’s net zero ambitions,” he says. At the same time, he emphasizes that “there is a lot more to DSM than this specific project”.

Marketing of Bovaer has only just begun, with sales still at an early stage. However, the feed additive exemplifies the strategic foresight that goes into decisions made at the company’s headquarters in Heerlen, the Netherlands: when research into Bovaer began more than 10 years ago in Kaiseraugst, Switzerland, hardly anyone in the world was concerned about methane emissions from livestock. Another example of what Arets calls a “revolution” in the field of animal nutrition is Veramaris. A joint venture with chemical company Evonik centers on harnessing algae to produce omega-3 fatty acids. These are an indispensable feed additive in aquaculture, which currently uses omega-3 sourced from fish oil. According to DSM, Veramaris can produce amounts of omega-3 equivalent to that obtained from 1.2 million tons of wild-caught fish – more than the annual catch from the Mediterranean Sea.

Great hopes rest on this unassuming powder: DSM’s methane-reducing feed additive Bovaer.

A quarter teaspoon of Bovaer daily per animal reduces methane emissions from dairy cows by 30 percent and from beef cattle by 45 percent.

UNIQUE TRANSFORMATION

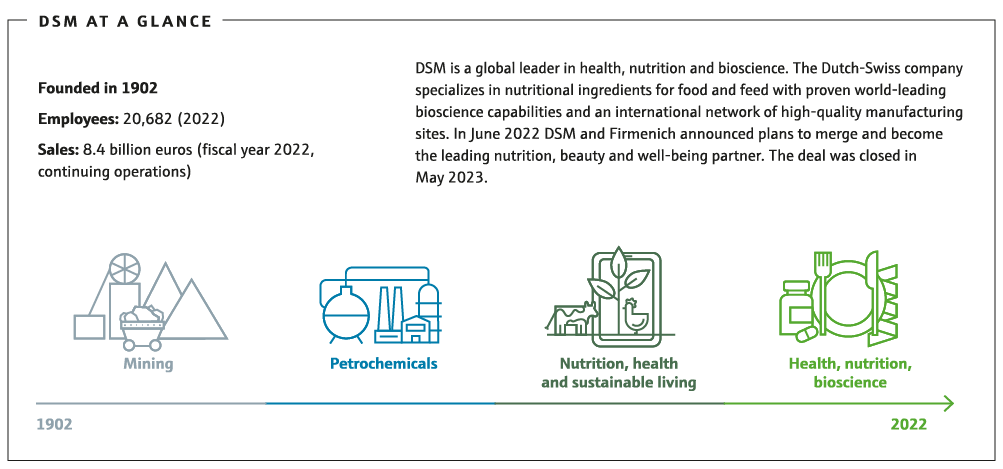

Today DSM has more than 1,200 scientists driving the search for such innovations. The quest for new paths is firmly inscribed in the corporate DNA. Starting as Dutch State Mines in 1902, the company established a chemical division early on that manufactured fertilizers and other products. Diversification was pursued more vigorously after 1945. When the last mine in the Netherlands closed in 1973, DSM was already operating as a chemical and petrochemical company. The acquisition of Roche’s Vitamins and Fine Chemicals division in 2003 shifted the focus to health, nutrition and sustainable living. In 2022 DSM divested its materials business to fully focus on health, nutrition and bioscience and announced its upcoming merger with Firmenich. The deal as completed in May 2023 to form DSM-Firmenich.*

Sjef Arets experienced and helped to shape the company’s transformation. “I was born in the south of the Netherlands where many people used to work in mining for Royal DSM.” At the time he joined the company more than 30 years ago, none of today’s business segments existed in their current form. “Today we are growing with a strategy directed at sustainability. We’re improving the lives of many people.” Consumers use hundreds of DSM products on a daily basis, such as ingredients in food and beverages, dietary supplements and infant and medical nutrition. “Our products reach around 2.5 billion people, although few are really aware of that,” explains Arets.

* The interviews for this article were held in December 2022.

“What we ultimately look for in partnerships is something that goes beyond the pure transactional value of the supplied product.”

Sjef Arets

Vice President of Manufacturing & Technology Animal Nutrition & Health at DSM

CLOSE PARTNERSHIP

DSM would be happy to see this reach extend further still. The company is seeking growth through new products – and improvements to established ones. “That’s what makes evolutionary improvements to processes in our existing plants equally important,” says Arets. “Partners like Endress+Hauser play a vital role here.” The evolution of a process established for decades is evident in Grenzach, where every processing step of the recently modernized vitamin D3 production runs with instrumentation from Endress+Hauser. From reliable level switches to high-precision Coriolis flowmeters, the entire portfolio is employed. Martin Häfele, Managing Director of DSM in Grenzach, explains from the perspective of his location: “I’m happy that we are buying not only measurement instruments but a solution that makes our processes better overall. That helps us to offer our quality at a competitive price.”

Key to this is a special partnership. Endress+Hauser sees DSM as a strategic customer, as Michael Sinz, Director of Strategic Business, explains. “We aim for close relationships with customers who are leaders in their sector and who are open to collaboration. What we seek here are opportunities to learn and generate long-term growth. Ideally, there should be a good fit in terms of brand values, commitment to quality and corporate culture. And that’s the case with DSM. We have similar mindsets, we are strongly driven by innovation and oriented toward sustainability.” From an operative standpoint, Endress+Hauser supports DSM and all of its worldwide locations with a global network that includes services and engineering.

In the midst of state-of-the-art production technology, personal relationships are still essential.

DSM uses a wide range of measurement technologies from Endress+Hauser, including pressure instruments.

DIRECT TIES

In an internal evaluation of key suppliers, DSM gave Endress+Hauser a top mark of 100 percent. One person pleased with this result is Markus Schmitz, who manages DSM’s account at Endress+Hauser together with his teams. His trump card is close proximity to the customer – in more ways than one. His home office is situated just 30 kilometers from DSM headquarters in Heerlen, the Netherlands. Schmitz and his counterpart at DSM, Ronald Diedering, represent the close connection between the two companies. As Global Senior Category Manager, Diedering holds worldwide responsibility for the business side of process control. In this role he develops and manages strategic supplier relationships, such as the one with Endress+Hauser.

“You can’t place enough value on this partnership,” emphasizes Markus Schmitz. “There is a dedicated steering committee, which regularly discusses strategic issues, as well as cross-company management meetings.” Regularly sharing information and asking questions provides Endress+Hauser with a deeper understanding of the processes, which in the best case leads to further added value for DSM. “For example, we established a dedicated electronic order management system with all of the technical information related to our portfolio,” explains Schmitz. “DSM employees can use it to select, size and order products at contracted prices.” Solutions like that are not a given in the B2B sector. Sjef Arets values how the system simplifies his staff’s daily activities. “What we ultimately look for in partnerships is something that goes beyond the pure transactional value of the supplied product.”

CONNECTED IN THE FUTURE

In terms of process measurement technology, the cooperation between DSM and Endress+Hauser is bearing its most recent fruit in Sisseln, Switzerland, where the partners installed a Raman analyzer in a chemical plant. “This technology’s biggest advantage is that we can monitor the process directly and in real time, which enables us to respond immediately to changes,” explains Sjef Arets. Making this possible are measuring probes that use a laser light-scattering technique to determine the chemical properties of a substance – all without detouring through the lab. Compared to other technologies, Raman spectroscopy supplies more comprehensive process data, operates more reliably and requires less maintenance.

The partners also hold regular discussions on future technological challenges. One of those is digitalization of the production environment, which DSM aims to accelerate in the coming years. Production expert Sjef Arets is confident about one thing: “We will further automate processes and increase connectivity in our plants. For this we need enabling partners to help us generate new added value from digitalization.”

“We aim for close relationships with customers who are leaders in their sector and who are open to collaboration. What we seek here are opportunities to learn and generate long-term growth.”

Michael Sinz

Director of Strategic Business at Endress+Hauser

Published 31.05.2023, last updated 14.06.2023.

Dive into the world of the process industry through new exciting stories every month with our «changes» newsletter!