The financial year at a glance

Endress+Hauser has exceeded its own expectations and achieved record-high incoming orders, sales, profit and headcount. See all 2023 facts and figures here.

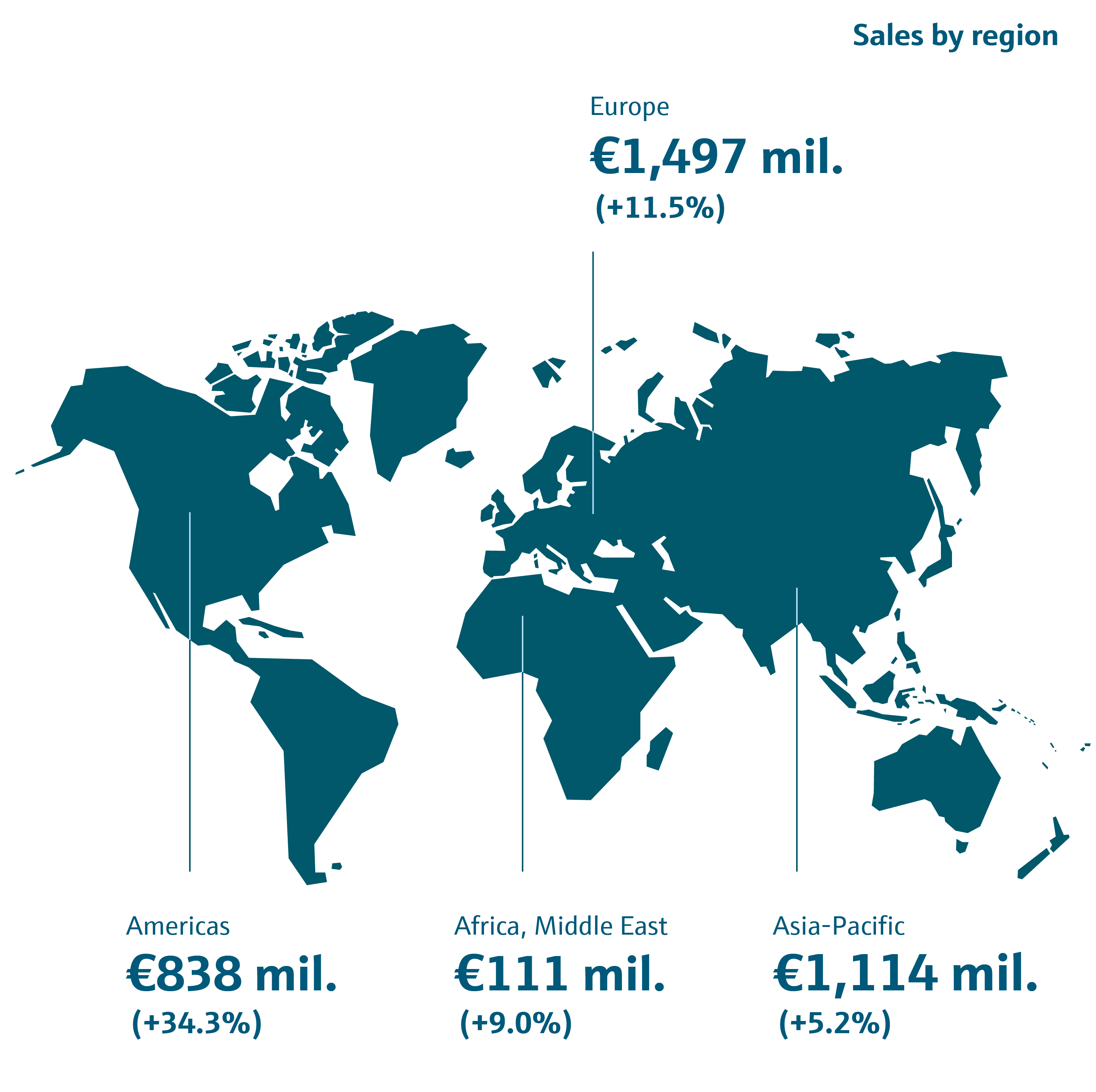

Americas and Europe also grew at an above-average pace.

|

How did Endress+Hauser perform in the past year? |

Strong growth

Sales for the Endress+Hauser Group once again showed a strong increase in 2023, underpinned in part by a record volume of orders in hand. This was despite foreign exchange effects costing us nearly four percent in growth. Momentum slowed in the second half of the year, but we were still able to maintain incoming orders at a solid level and close out the year once more with a high backlog of orders.

As a family company, Endress+Hauser has access to extensive strategic financial resources. Depending on how the capital markets developed, these resources have repeatedly had a strong impact on our result in the past. For this reason we will focus our future balance sheet reporting on the operative business. This leads to a significantly lower equity ratio. But as in the past, we are not dependent on external creditors and have reduced bank loans to nearly zero.

DR LUC SCHULTHEISS, CFO

Published 27.03.2024, last updated 17.04.2024.

Dive into the world of the process industry through new exciting stories every month with our «changes» newsletter!